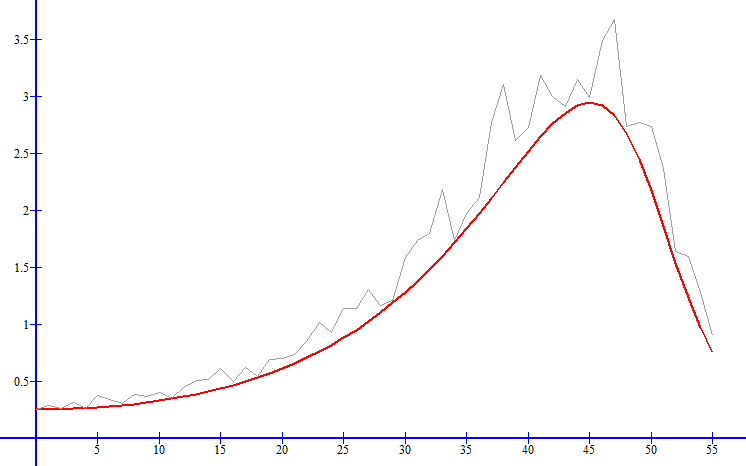

Votlaerra-Lotka or prey-predator equations resemble stock market graphics. An increase in volume is offset by an increase in price, which brings down the volume of trades. We have,

x’ = x – xy

y’ = -y + xy

If x is the prey, the interaction with the predator is negative. The opposite is true for the predator. Negative y indicates the predator would die out with no prey.

There is no time variable aside from x’ = dx/dt. Euler’s method is used to plot the trajectory.

Sub vl_euler()

‘ dx/dt = x(1-y)

‘ dy/dt = y(-1 +x)

n = 55

Dim x(0 To 55) As Double

Dim y(0 To 55) As Double

Dim xr As Single

x(0) = 0.25

y(0) = 1

h = 0.1

Cells(1, 1) = 0

Cells(1, 2) = x(0)

For i = 1 To n

Randomize

xr = Rnd

x(i) = x(i – 1) + h * (x(i – 1) * (1 – y(i – 1)))

Cells(1 + i, 2) = x(i) * (1 + xr * 0.4)

y(i) = y(i – 1) + h * (y(i – 1) * (-1 + x(i – 1)))

Cells(1 + i, 1) = i

Cells(1 + i, 5) = xr

Next i

End Sub